Payroll and Tax Solutions for Small and Medium-Sized Businesses

Automate and outsource the complex management of wages, direct deposit, tax codes, and all payroll and tax functions to experts who ensure you remain compliant.

Payroll Doesn’t Have to Be Complicated

Our Payroll & Tax solutions relieve the burden of payroll so you can focus on growth

- Save time and money by streamlining your payroll and tax management processes.

- Find peace of mind in knowing you are compliant with Affordable Care Act (ACA) and payroll tax legislation.

- Reduce duplication of information by seamlessly integrating with your General Ledger, including QuickBooks Online, as well as time & attendance solutions.

- Improve employee satisfaction by providing employee self-service for easy access to pay information and other information.

- Entrust your data to a provider with the highest standards in security and who can provide third party audit reports to prove it.

The Right Solution for Your Business

Whether you are a business owner, manager, or payroll professional, we have a solution to meet your requirements. Our payroll and tax products are flexible, scalable, and reliable. With mobile, cloud-based software, and full-service options, we can handle both simple and complex payroll and tax management needs.

Highly Secure, Highly Auditable

With our company as your payroll & tax provider, you will know your data is secure, safe, and compliant.

- Highly Secure Technology

We uphold the highest standards in security. All of our applications and data are securely hosted and protected. We have stringent information security controls in place to protect client data. Clients using our cloud-based software can even customize security rights so individual users only have access to what you choose.

- Regular Audits

Our software passes SOC 1 Type 2 audits every six

months and SOC2 Type 2 audits on an annual basis. SOC audits are completed by an independent third party to ensure all necessary controls and systems are in place.

- Fully Compliant

We are compliant with the strictest privacy standards, including the Health Insurance Portability and Accountability Act (HIPAA).

Feel Confident Your Payroll is 100% Compliant

Increase productivity and reduce headache by working with a proven, trusted payroll and tax provider.

- Never worry about tax rates again

We maintain federal, state, and local tax rates, tax brackets, and statutory limits, and our tax professionals continuously manage and update the tax management engine. - Save time processing payroll

Manually inputting payroll can take up a great deal of time. Our solutions provide easy-to-use interfaces

to enable users to enter payroll themselves. Whether you are a payroll professional or a small business owner with limited payroll experience, we have a solution that is just right for you. - Reduce liability concerns

As a provider, we assume the liability of managing payroll and HR data and filing taxes on your behalf. Outsourcing your payroll to us means protecting your business from costly compliance mistakes. - Simplify earning and deduction management

Manual payroll processing can easily result in profit leak and errors. We can handle any type of earning or deduction, from wages to benefits, overtime, garnishments, tips, and more, to ensure your payroll is

completed correctly and quickly.

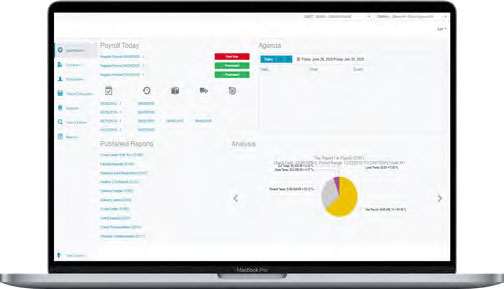

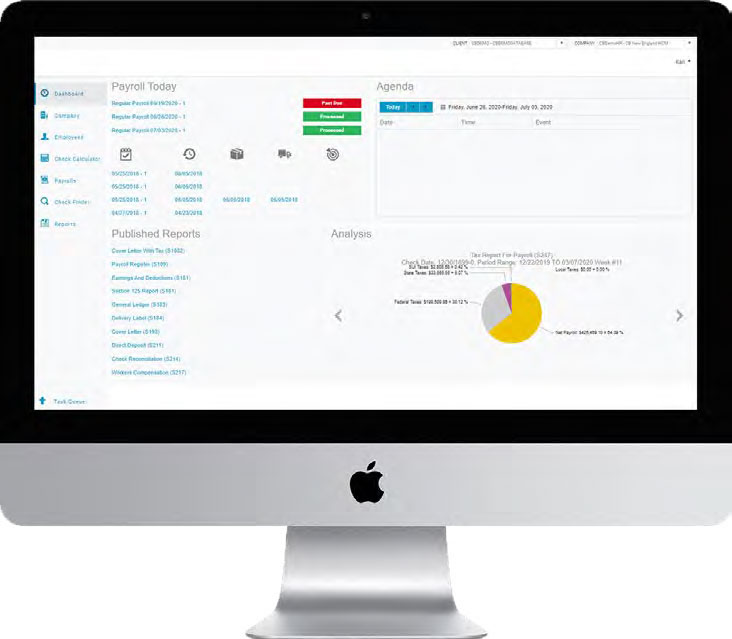

Easy-to-Use Reporting

Access key business information whenever you need it.

- Validate your payroll data at-a-glance

We provide a variety of easy-to-access reports essential to business operations, including reports

on pay, taxes, deductions, PTO, and general ledger interface reports. - Understand your Affordable Care Act responsibilities and avoid penalties

We have a comprehensive suite of Affordable Care Act (ACA) tools and reports that make it easy to assess and report on employees’ eligibility status. Our software allows you to monitor and maintain the employee’s ACA compliance and determine the impact of ACA on your business with reports such as:

- Forms 1094 B/C and 1095 B/C

- ACA Full-Time Employee (FTE) Report

- ACA Eligibility Analysis Report

- Rule of Parity Report

- Inactive Employee Report

- ACA 1095 Edit Report

- 1095 Preview Report

- ACA Affordability Report

- ACA Status Report

Eliminate Duplication of Effort with Time-Saving Integrations

Whether you want to connect to your accounting system or your time and attendance software, we can provide a seamless experience

Easily update your accounting system

With general ledger integration, you can simplify your reconciliation process. Payroll data can be automatically uploaded to your accounting system, eliminating the need for data entry between payroll and accounts. We also integrate with QuickBooks Online so that pay data flows directly into QuickBooks- no effort required.

Utilize one-click import of labor hours with our time and attendance software

We can automate time entry with the payroll and tax software. There is no longer a need to key time and

attendance information into payroll separately. Simply point, click, and import your time-clock file.

Improve Employee Satisfaction with Self-Service Functionality and Dependable Payroll Processing

Enable employees to conveniently access their data online, reducing the number of requests sent to payroll and HR

- Never worry about paycheck errors

When it comes to managing employees, nothing is more important than making sure their paychecks are accurate and delivered on time. With us as your payroll provider, you can rest easy knowing your payroll is processed by experts. If needed, paychecks and stubs can be generated and printed on-site, at your office or place of business. - Empower employees to manage their own pay information

The Employee Portal allows employees to view and update personal information, review and print paychecks, and manage and view W-2 information. The Employee Portal can be accessed on mobile devices as well as standard computers. - Create workflow efficiencies for managers

The Employee Portal provides a number of benefits for managers as well. Managers can send company-wide announcements and alerts through the Employee Portal, view and approve data changes, and control which features are enabled for employees through the portal.

Why Should You Outsource

Your Human Capital Management?

We deliver human capital management (HCM) solutions for businesses so owners, executives, entrepreneurs, and managers can focus their time and energy on growth.

With our personalized service and support, you’ll have a partner that truly understands your market and your business.

Payroll & Tax

We maintain federal, state, and local rate tables and file taxes on your behalf. With general ledger integration, managed garnishments, and automated ACA compliance and reporting capabilities, payroll is easier than ever.